The importance of a strategic and tax efficient portfolio withdrawal becomes very clear to retirees or those funding their daily expenses from their portfolio (i.e., those who are financially independent).

Though we have all become pretty comfortable with deferring income to gain a tax advantage while working (through 401K, 403b, 457, Keogh, and IRAs), we delay learning about how we’ll deploy these accumulated assets until some later date. We usually include one possible distribution in retirement projections but we leave the actual details until closer to retirement. This includes ways to manage Required Minimum Distribution (or RMD).

Essentials of RMD:

Starting at age 70.5 and each year after you will be required to withdraw from your tax-deferred accounts a portion regardless of whether you need it to fund your expenses (this is the crux of RMD). This amount is fully taxable as if it were income (it is after all your prior deferred income). The required withdrawal amount is a portion that is dependent on your account balance and your age.

How is the amount of RMD determined?

Every year it is calculated on the total account balance, at prior year end, of all of your tax-deferred accounts divided by an annuity factor. This factor is based on your age and the age of your spouse (slightly different factor if the difference between you and your spouse’s age is greater than 10 years). As an example, I’m using factor 26.4 for a person age 71. If this person’s total tax-deferred portfolio on the prior December 31 had a balance of $500K then their RMD would be $18,939. If the same individual had a $3M portfolio they would have to withdraw at least $113,636.

Why not ignore this requirement and pay the penalty?

Required Minimum Distribution (RMD) has a 50% penalty. If the above RMD withdrawal is not made in the specified period, then the penalty for the $500K portfolio would be about $9.4K and $56.6K for the $3M portfolio – Yikes!

Keep in mind that RMD is the MINIMUM amount you MUST withdraw from your tax-deferred accounts each year but you can draw more if you wish. Everything you withdraw from your tax-deferred account (except for advisory fees) is fully taxable and impacts tax liability and cash flow.

When and why might RMD be a problem for retirees?

The basic problem is lack of control over timing of distributions. The strategic deployment of a portfolio is tax dependent, market dependent and most of all it is ‘needs dependent.’ If we have a choice, we only want taxable income to the level it is needed by you for that year. Sometimes we take more because we are planning for a future event.

Taking RMD can increase tax liability excessively in specific years, because you are temporarily in a higher tax bracket. This happens most often when a home or other large capital asset is sold (or may last longer if it is due to distribution from a company deferred compensation plan). In those years it would be best not to withdraw from a tax-deferred account since there is enough cash flow and tax liability from the sale. Adding RMD serves only to increase tax liability unnecessarily. It also impacts Medicare premiums (recall that Medicare is means tested – see the March 2016 Nibbles article (or online blog) for details on Medicare means testing).

An additional problem arises during years when market corrections take place or if portfolios are not fully diversified. During the 2000 and 2008 crises, equity markets were at their highest the prior year-end, but after the crisis they dropped significantly forcing a crisis for those who had not made their RMD withdrawals. We prefer not to add these potential risks to our client portfolios during retirement – we make RMD withdrawals early in the year and we ensure retirement portfolios are diversified and therefore less volatile.

What action may minimize the impact of excessive taxes caused by RMDs?

Currently there is only one solution after age 70 but several if you plan ahead.

In the years prior to age 70 you can take advantage of several strategies that effectively decrease the tax-deferred account balance and provide alternatives without RMDs. The objective is to even out the tax rates and reduce years of higher tax rates.

During retirement there is no way to avoid this increased tax liability from RMDs unless you don’t need the RMD for your personal retirement needs. If you don’t need the RMD, it can be donated to a qualified charity (there is a specific process that must be followed) and meet your RMD requirement without increasing your tax liability. Obviously this is a limited solution since to avoid the penalty and taxes you are giving away the RMD but hopefully it is going to a cause you care about.

How do we plan portfolio withdrawal given RMDs?

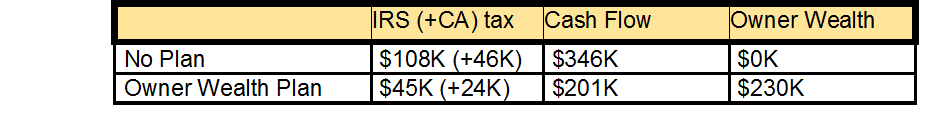

Like all questions regarding retirement or financial independence we need to always begin by knowing what you want to do and how much you need to spend (your burn rate). We’ve also found greater success when we have several funded pools of retirement assets with different tax natures. In planning distributions we consider cost basis, burn rate, tax brackets, social security, and RMDs, along with the current tax rules so as to create the most appropriate distribution from the portfolio. If we plan ahead, we find that spreading-out tax liability over several years (with a lower effective rate) often helps in this endeavor.

Financial plans create retirement scenarios that provide a high probability that the portfolio assets will support your planned retirement spending and provide you with confidence that your savings level today will support your chosen lifestyle in the future. It is during implementation of the retirement plan that rules and priorities (for example, how to handle RMD, taxes, cost basis) need to be applied as to further improve the probability that your portfolio will outlast you.

Edi Alvarez, CFP®

BS, BEd, MS