As you would expect, we often think about ways to supplement client retirement income and diversify a client’s finances beyond their market portfolio.

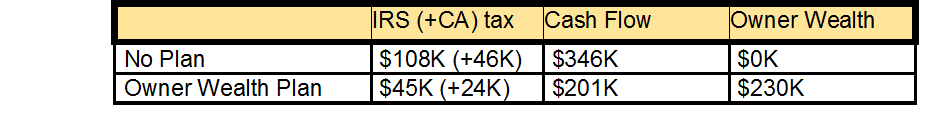

Owning one or more rental properties (commercial real estate) can provide a steady source of income and cash flow during retirement, with the added advantage of building owner equity (owner wealth). Once established, rental properties can also be a great resource to meet both planned and unexpected life events. And since they can be depreciated on your income tax, rental properties can provide a significant tax advantage while the asset actually gains in value. All this said, owning a rental property, let alone more than one, is not for the faint of heart. Without regular attention and constant re-appraisal, they can become a major headache and a huge liability.

The path to becoming a commercial real estate investor (a fancy way of saying “landlord”) often begins, innocently enough, with owning a single family home and then, for whatever reason, deciding to convert it to a rental. In this case, the property may need to be adapted in some fashion to accommodate renters. Others will approach a real estate agent with the deliberate intention of purchasing a rental property, in which case the property may be “turn key,” requiring little, if any, alteration. Whichever way you start out, the following are just some of the things you need to take into account before you commit to becoming a landlord in your golden years.

Commercial real estate requires at least 20%-30% down payment and an ongoing source of cash flow to fund expected and unexpected expenses. This means your equity will be locked in your property and only available through the available cash flow stream.

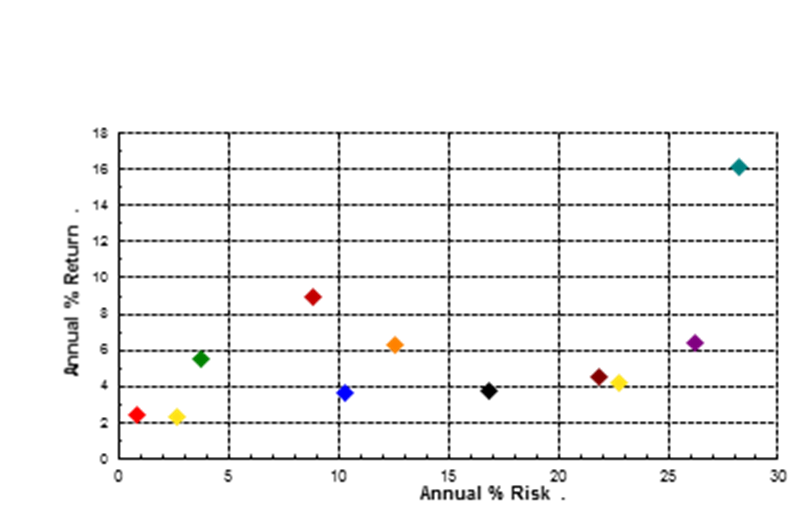

Real estate can be a great addition to an investment strategy, but rarely prudent as a sole investment. Unlike your portfolio, which will have fixed expenses, be liquid and globally diversified, your real estate will be impacted by local conditions with unexpected expenses and periods of poor liquidity. Expenses that are predictable include mortgage, taxes, landlord-specific insurance policies (both property and liability). Less predictable expenses are maintenance and repair costs as well as tenant related expenses. For those in control of their family cash flow, it is this difference that makes rentals a good consideration as a secondary investment and as part of their financial plan.

Like all investments it takes time and due diligence to generate a stable positive cash flow from rental properties – luck alone will not suffice. The price you set for rent is all important as are the expenses you incur. You need to be sure to cover your operating expenses which can include mortgage, property tax, insurance, maintenance, bookkeeping and accounting fees, utilities and if you use a management company you must also include their fee. In addition, the rent must provide you with a reasonable return based on cash flow, not just property appreciation, since you can’t sell the property to pay for ongoing expenses. The property must remain competitive with the local rental market and your cash flow able to cover expenses that may not be deductible in the year they are spent (a roof is an example of an expense that is depreciated and not deductible).

In addition to the financial considerations cited above, you will have legal obligations that are based on local laws and regulations pertaining to rental housing. A broken water pipe, furnace or refrigerator? Round-the-clock availability for emergencies is your responsibility. You can, of course, assign or pay for someone to take care of such things, but the legal responsibility will still be yours (always have sufficient liability and property replacement insurance). You are likely to be held liable for tenant or visitor injuries if due to unsafe conditions, especially in the common areas. Safety and habitability is paramount. On a regular basis, you must make sure structural elements are safe, the electrical, potable and wastewater infrastructure is sound, that trash containers are provided, that any known or potential toxins (such as mold or asbestos) are properly managed, that rodents or other vermin are kept clear off the premises.

However you come by your rental property, you will have to choose whether you should be your own property manager (directly overseeing and paying for maintenance yourself) or to take a more arms-length approach by contracting with a property management firm. Some clients hand these tasks to a family member who wishes to work part-time while others hand it over to a professional. A property manager can help those who wish to limit their day-to-day responsibilities, especially if you aren’t the handy sort or aren’t physically up to the task, but then you will have to cover the additional expense. Property managers, in simple terms, are hired to find tenants, maintain the property, create budgets, and collect rents. You will want to hire someone who knows about advertising, marketing, tenant relationships, collecting rent, maintenance, plus local and state laws in the location that you have the property. As the property owner, you can be held liable for the acts of your manager. It’s prudent, therefore, to hold the rental property in an entity that can provide some legal protection. Costs for contracting a property manager will usually run about 8% of rental income for management and about the same for engaging new tenants—this can eliminate your profit but if properly priced will provide you with a sustainable model well into retirement.

Finding reliable tenants is always a challenge, even if you employ a property manager. Tenants need to be able to pay their monthly rent, keep the property in good condition, and follow policies in the lease or rental agreement. You’ll find it easier to find good tenants if you select a property in an area experiencing low vacancies and high demand. Unfortunately, this means the property will also cost you more.

You should be prepared to have to deal with (or have someone deal with) evictions, wear and tear on your investment, unauthorized sub-lets, termination without proper notice, smoking, illicit drugs, pet odor and damage, parking and waste management issues, advertising, noise (including sometimes difficult neighbor relations), and other eventualities. Or, you can get lucky and find perfect long-term tenants! Realistically, as you age these tasks may become too stressful, eventually requiring you to hire a property management company or engage a (younger) interested and motivated loved one to take on this role. Either way, you must put this in writing as part of your purchase plan—including when you want this to happen, who this person should be, and finally, when the property should be sold.

During retirement some will love the ability to work part-time at managing their properties (even if only in a limited manner) whereas others will find it too complicated for their ideal retirement life. Invariably a well-managed property can generate ongoing income and create owner equity that will be a godsend in retirement or as an alternative to your market portfolio. Unfortunately for some, the process can become too complicated and stressful. So much so, that they avoid the tough decisions and derail their entire retirement plan. Being a landlord is very much an individual decision.

The bottom line is that rental property cash flow can generate a stable income during retirement, and can provide needed equity to fund contingency plans (such as disability, long-term care, health care needs, legacy) but profiting requires planning and annual review. It is a business that needs your ongoing attention or it will become a major liability. Even with the help of a property management firm, you may wonder in what way you can really consider yourself “retired” owning and managing rental properties.

Like any other financial investment, do your homework, and moreover, make sure it fits with your long-term financial goals and vision for a rewarding life.

Edi Alvarez, CFP®

BS, BEd, MS

www.aikapa.com