Here we go again – we’ve been down a similar road before, so none of this is news to those who have been with us through prior overreactions by market participants.

Volatility is part and parcel of participating in the market. When fear grips the market, selloffs by those who react to that fear provide portfolio opportunities for those who understand and adhere to a strategy. It is AIKAPA’s strategy to maintain your risk allocation and either ride out the volatile times or rebalance into them. Meaning that if you don’t need cash in the short-term, we buy when everyone else is selling.

As news of the Coronavirus (or other events outside of our control) stokes fear and uncertainty on a variety of fronts, it is only natural to wonder if we should make adjustments to your portfolio. If you are reacting to fear, then the answer is a resounding NO. On the other hand, if you are applying our strategy in combination with an understanding of the impact on business, then the answer is likely YES. When an adjustment is indicated we look for value and BUY while selling positions that are relatively over-valued. If the market continues to respond fearfully (without a change in value) then we will likely continue to buy equities and may sell bonds to fund those purchases. The only caveats to this strategy are that we must know that you don’t have short-term cash flow needs, that we stay within your risk tolerance, and that we are buying based on current value (keep in mind that value is based on facts not fear).

If you feel compelled to do something, then consider the following:

- Contact your mortgage broker and see if it makes sense to refinance (likely rates will drop soon after a significant market decline).

- Seriously examine the impact this has on your life today and let’s talk about changing your allocation once markets recover.

- Review the money you’ve set aside for emergencies and prepare for potential disruptions if these are likely.

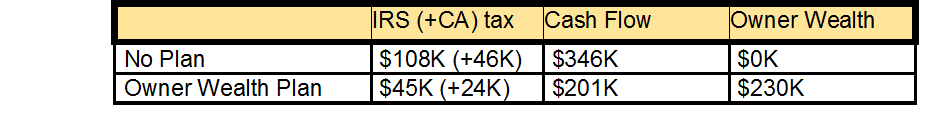

- Business owners should consider the impact (if any) on their business, vendors and employees. Particularly important will be to maintain communication with all stake holders and retain a good cash flow to sustain the business if there is a possibility of disruptions.

- Regarding your portfolio, if you have cash/savings that you want to invest, this is a good time to transfer it to your account and have us buy into the market decline.

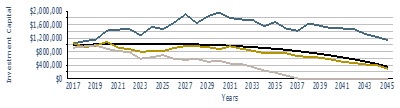

Market changes are a normal part of investing. Risk and return are linked. To earn the higher returns offered by investing in stocks, it is necessary to accept investment risk, which manifests itself through stock price volatility. Large downturns are a common feature of the stock market. Despite these downturns the stock market does tend to trend upwards over the long-term, driven by economics, inflation, and corporate profit growth. To earn the attractive long-term returns offered by stock market investing, one must stay invested for the long-term and resist the urge to jump in and out of the market. It has been proven many times that we can’t time stock market behavior consistently and must instead maintain portfolio discipline (if you want a historical overview of markets, see the “Market Uncertainty and You” video on our website www.aikapa.com/education.htm).

It is your long-term goals and risk tolerance that provide us with our guide to rebalancing and adjusting your portfolio, not short-term political, economic or market emotional reactions. In your globally diversified portfolio, we will take every opportunity to rebalance and capture value during portfolio gyrations. This IS the benefit of diversification and working with AIKAPA.

Edi Alvarez, CFP®

BS, BEd, MS