Long Term Care (LTC) decisions form a critical part of all retirement plans. That said, we can’t properly address individual LTC needs until a retirement plan is designed and participants are able to quantify the aspect of Long Term Care they will fund. If LTC insurance is part of their ideal LTC plan then we must identify the best policy and the most cost effective way to pay for it. This article is intended to review LTC and layout how a business can help pay for LTC insurance in a cost effective manner.

(1) Long Term Care – a review

Long-term care (https://longtermcare.acl.gov) is a range of services and supports needed to meet personal care which is not included in healthcare. About 2/3 of the population will need LTC after age 65 (and 1/3 before 65). Of those reaching age 65, 70% will need LTC or assistance with activities important to life. LTC includes everything from social services, physical and emotional support, finances, housing, a myriad of legal decisions, family interaction and social dynamics. LTC should include all assistance with tasks that will allow for productive, engaged and enthusiastic daily life. It should include assistance with routine tasks such as housework, money management, taking medication, shopping, traveling, caring for pets, responding to emergencies (these are known as Instrumental ADLs) and NOT just the “basic” Activities of Daily Living (ADLs, such as assistance with bathing or eating).

Currently, 80% of all LTC needs provided in the home are supported by unpaid family, friends or neighbors. The average support needed in the home is about 20 hours per week. Fortunately, as services develop, we find an increase in community support services. These include adult care services, transportation services, and home care that is round the clock or as needed.

If you require or prefer the use of LTC services provided by an institution or facility you will need to investigate Assisted Living, board and care homes, or Continuing Care retirement communities, not just nursing homes.

(2) What is LTC insurance?

LTC insurance is a contract to pay premiums every year for care you may need in the future. It will pay out an agreed daily amount for your care only if you are unable to do a certain number of Activities of Daily Living (ADLs). These are the basic ADLs (includes bathing, eating and dressing). LTC insurance is not usually available if there are pre-existing conditions. Benefits are provided for a set number of years of care based on a daily dollar amount dependent on local costs and total maximum benefits (these are usually capped at around $350K). But how many years of LTC will be needed is unique to the individual, though we have past indications that males need at least 2 and females 4 years. Three years is the standard, but we know that 20% of those over 65 years will need ADL assistance for longer than 5 years. For these reasons we recommend this insurance purchase be made based on your retirement plan.

Naturally, LTC insurance premiums are less expensive for the young (and healthy) but starting early will cost more over time and is not advisable if your personal cash flow can’t support this expense throughout your life.

(3) Best ways to pay for LTC insurance

How do we pay for LTC insurance if we think it fits within our retirement plan? It should be clear that healthcare or Medicare (except for very short periods of time and only in specific emergency situations) do not cover LTC costs. On the other hand, Medicaid does cover LTC but has very strict requirements to qualify. If you are fortunate to qualify, LTC coverage is provided by the Older American Act (OAA) and Department of Veteran Affairs.

The most common way to pay for basic LTC needs is through insurance or out of the personal or family budget. Other ways include a reverse mortgage, annuities, other assets, and income from a dedicated source (such as rental income).

LTC insurance premium costs are based on your age, your location, your wishes for level and amount of care. The premiums are not usually a burden on a yearly basis but they take a toll over time. These premiums must remain in effect for life. Additionally, policy premiums today can increase by more than inflation (over the last year we’ve seen 18% to 90%[!] increases in premiums for existing policies).

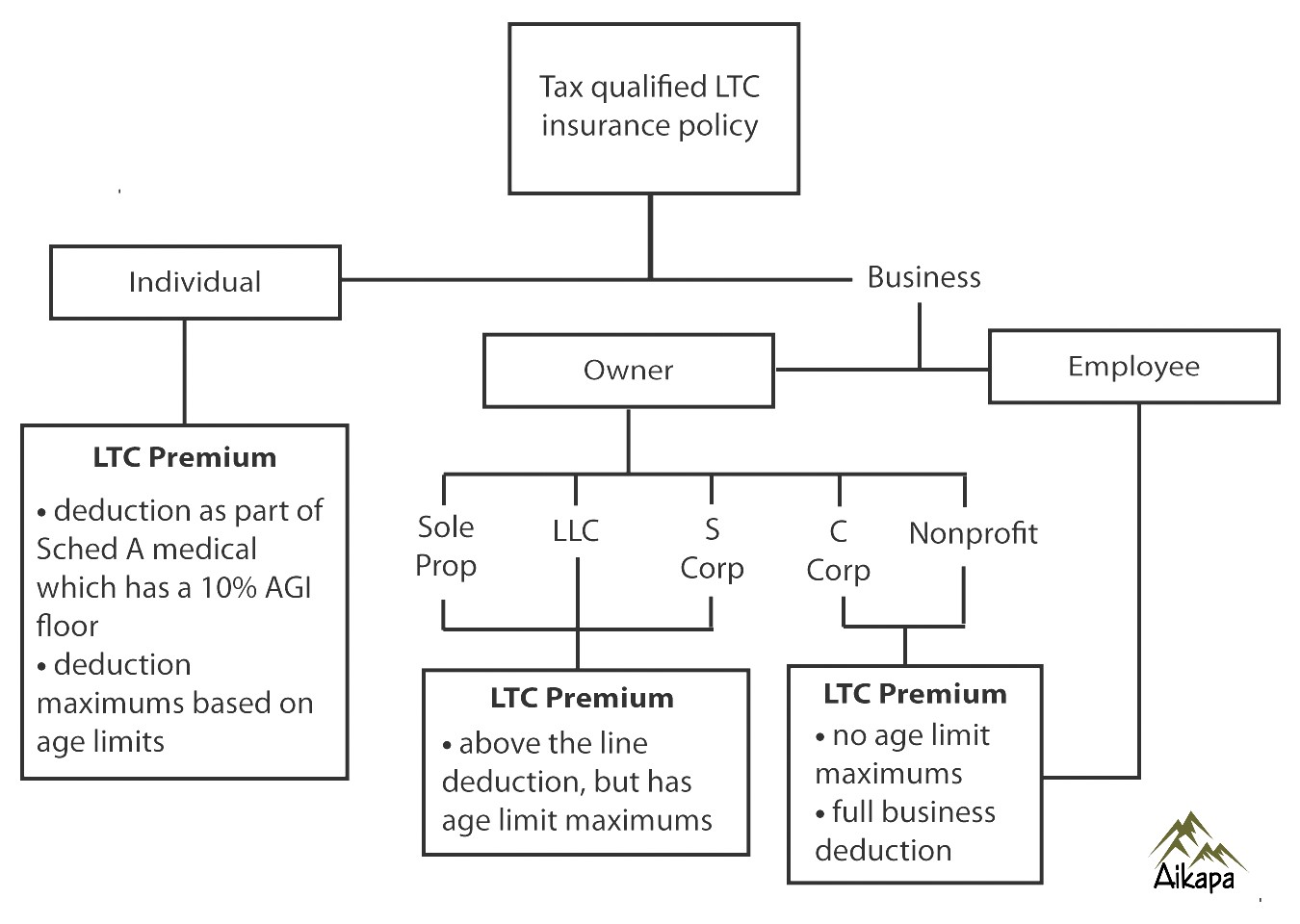

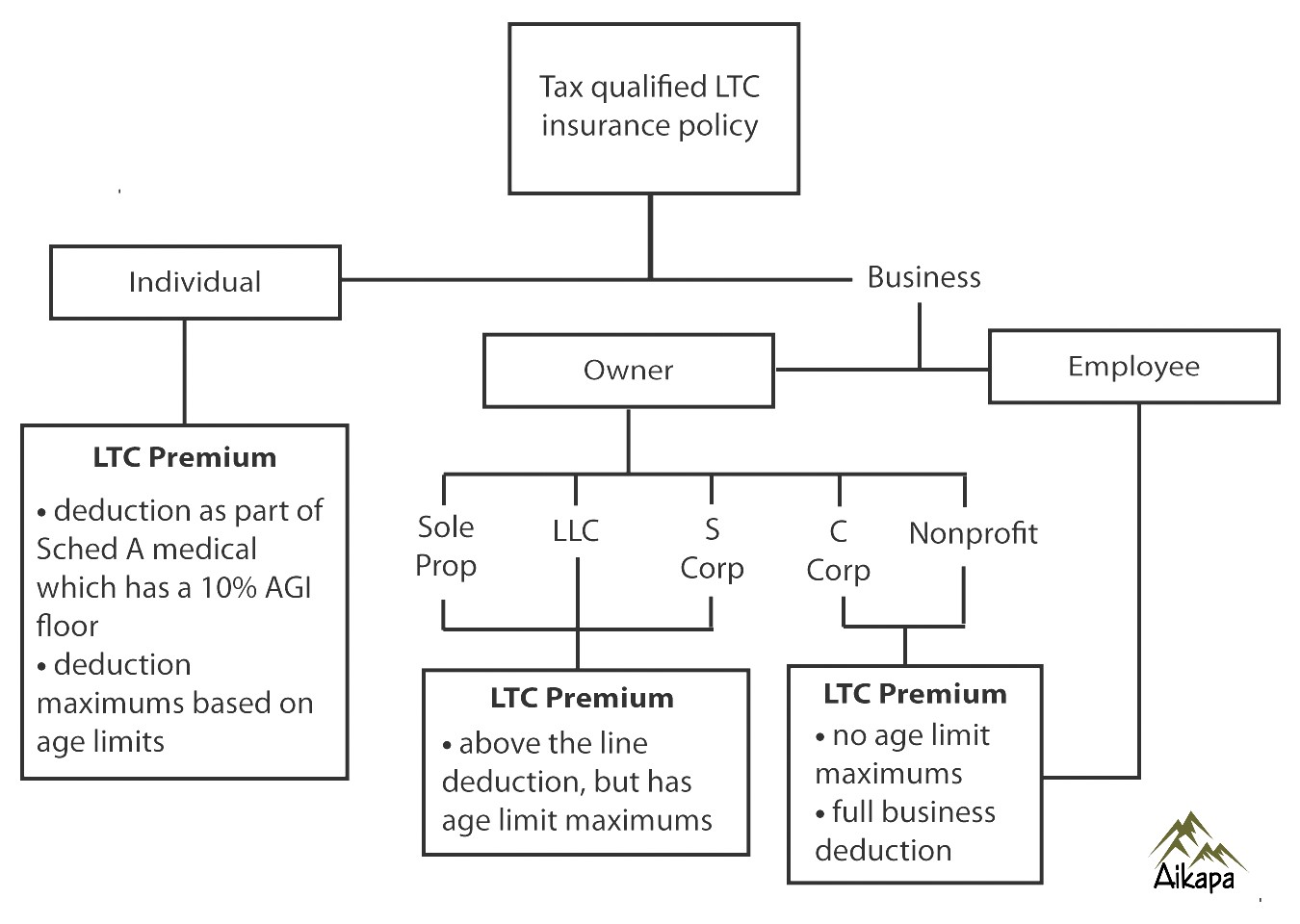

There are at least 2 ways to pay for a new LTC insurance policy – as an individual or as a business. The advantage of an individual LTC insurance policy is that it is based on your needs and can be tailored to you. The advantage of a business LTC insurance plan is that it can be paid by the business and therefore tax deductible. If you are the business owner it can also be tailored to your wishes (see the chart below assembled by Aikapa).

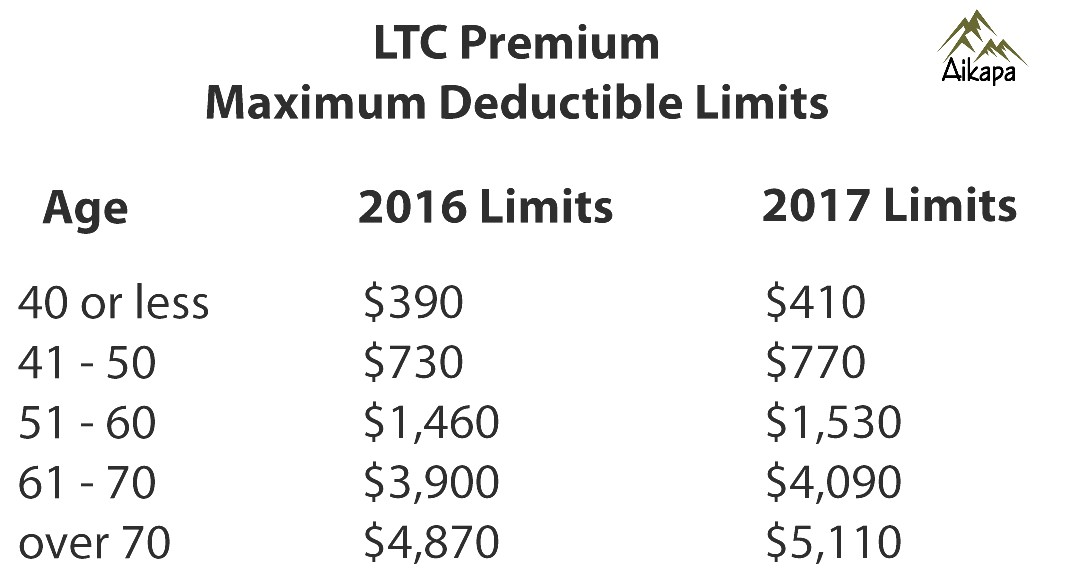

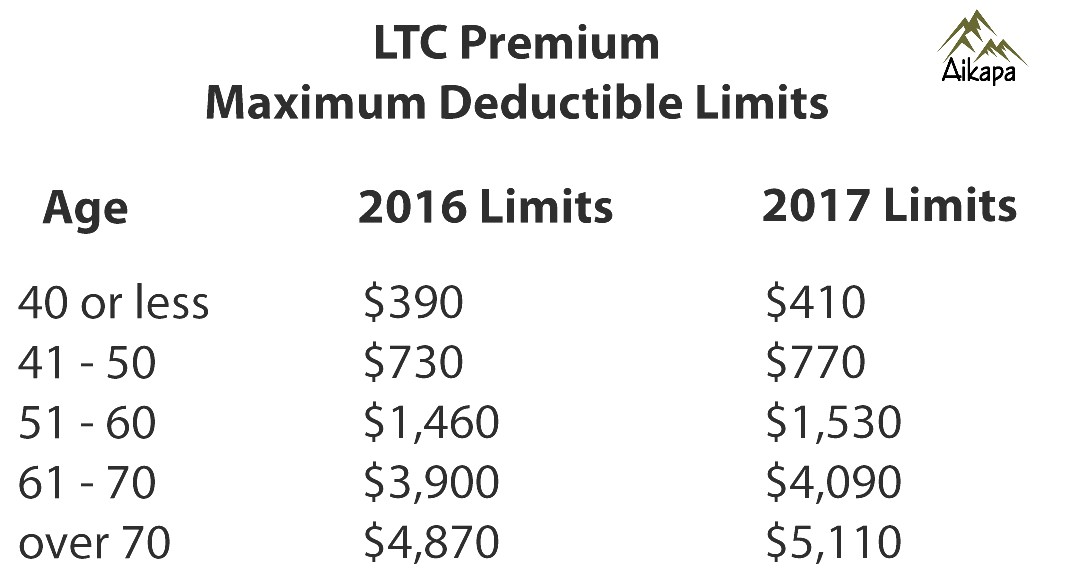

LTC insurance premiums are supposed to be deductible but we find that most of our clients with high AGI (Adjusted Gross Income) and low medical expenses are not able to deduct their premiums on their annual IRS tax filings (Schedule A has a 10% AGI floor). In addition, the deduction is also limited to age specific maximums (see table below) regardless of actual cost for the purchased LTC insurance policy. To help you understand the implications I’ll outline at LTC insurance for three separate age scenarios (ages 55, 61, and 71):

Currently a basic 3-year policy with $150 benefit per day would have an annual premium of around $2,100 at age 55, $2,900 at age 61, and $6,900 at age 71 (quotes may differ given different assumptions and are likely to be lower for males and couples but may be higher or not available based on health history).

To help understand how tax deductions actually work if buying this insurance individually, I’ll use the three LTC examples outlined above: To allow for this comparison, I’ve assumed that the cost of the above three policies are the only tax deductible medical expense. This is important because the deductibility is dependent on exceeding a 10% floor based on AGI. Anyone with an AGI (i.e. number at the bottom of the first page of your 1040 IRS filing) of more than $60K would not be able to deduct their LTC premium under any of these scenarios unless there were other deductible medical expenses. Most of our clients that purchase an individual policy are not able to deduct premiums. In retirement deductible medical expenses rise and then some of these premiums are tax-deductible.

On the other hand, the same insurance policy purchased by a business provides tax deduction of LTC insurance premiums up to age limits and may even cover the entire premium (see below for details).

Sole Proprietors, Partnerships, S Corporations, and LLCs can provide owners and spouses with LTC premium tax-deductions that are only limited by age specific maximums (see above table – which shows that at a business can pay up to $1,530 for an owner’s (aged 51-60) LTC premium tax-free). If we look at the same three examples AND purchase the policy using one of these firms the tax deduction in 2017 for the 55 year old would be $1,530 (less than the cost for a base policy of $2,100), the 61 year old would have their premium fully paid tax-free (since their premium of $2,900 is less than the maximum limit of $4,090 for her age group), and the 71 year-old would pay no tax on $5,110 (though premium total was $6,900).

C Corporation and non-profits may cover LTC insurance premiums for owners or members tax-free (without age limits mentioned above).

Using the same three examples AND having the C Corporation or the nonprofit pay for the premiums, then the entire LTC insurance premium for all age groups would be tax-free.

In summary, Long Term Care planning involves much more than just buying a LTC insurance policy. It encompasses consideration of a myriad of integrated services and support that should be aligned with your wishes both early and later in life. LTC insurance is one way to cover basic ADLs. Before making a purchase of LTC insurance you must have calculated what you wish to cover yourself and what will be paid for by insurance benefits. It is more cost effective if LTC insurance is provided by an employer (with no cost to you) and even better if you are the employer. As the employer you can design a policy that best fits your plan and offers tax-free premiums.

Edi Alvarez, CFP®

BS, BEd, MS

www.aikapa.com