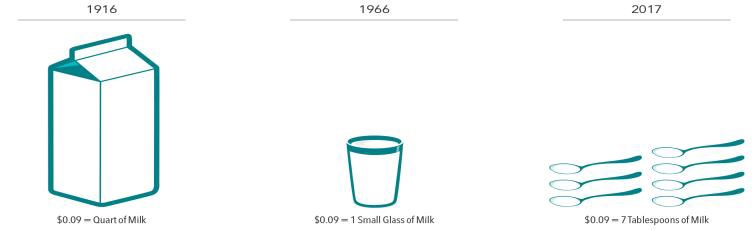

To date, we’ve all seen price increases (inflation) and also shrinkflation (smaller content of a product for the same price) but so far no hyperinflation. As consumers and investors, we participate in this process but seldom acknowledge the interplay. For example, when we decide to spend freely at this point in the economic cycle, we are contributing to inflation but not spending at all can contribute towards deflation.

To me, recessions are a natural cleansing mechanism for the economy. Over the course of economic expansions, companies become flush with excess. Meaning that their processes loosen, they hire too many people, they accumulate too much inventory. Recessions are a business cycle’s ‘diet plan’ for companies that need to shed excess but do so reluctantly – with negative growth. Recessions are never fun (the pain will certainly be felt more by those without adequate resources or with less certain employment), but historically they tend to be short-term interruptions between economic expansions. It is accepted that the greater long-term risk to the economy is not recession, but stagflation (slow growth, increased unemployment, and inflation) or even deflation (drop in demand for goods).

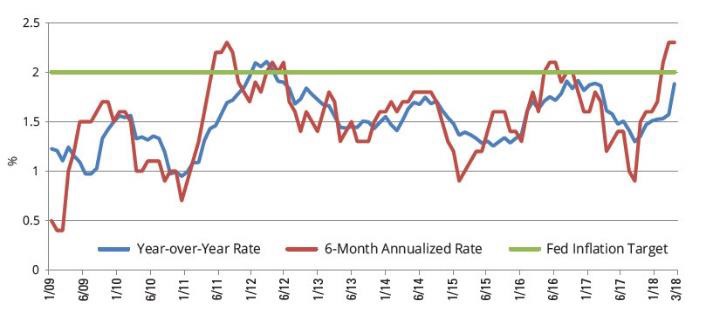

Despite headlines to the contrary the ‘tightening’ of monetary policy by the Federal Reserve is essential to economic recovery, which means raising interest rates have to be tolerated to slow down inflation and hopefully without dramatic increase in unemployment. With that, it is “quite likely” that the unemployment rate will rise “a fair bit” from where it is now, at 3.6%. If it rises more than a ‘fair bit,’ we could see a period of stagflation.

You’ll likely see headlines through the next months about the last time the US experienced stagflation. Briefly, in the 1970s the onset of stagflation was blamed on the US Federal Reserve’s unsustainable economic policy during the boom years of the late ‘50s and ‘60s. At the time, the Fed moved to keep unemployment low and to boost overall business demand. However, the unnaturally low unemployment during the decade triggered something called a wage-price spiral and hyperinflation. The impact of inflation on our economy will depend on the differential between the inflation rate and wage growth. This is what the Fed is trying to control as it maneuvers for a ‘soft landing’. The higher the unemployment, the greater potential for stagflation.

Stagflation may happen if a recession sets in before inflation has gone down low enough. For example, if unemployment were to go up to about 5% and consumer price index inflation was also above 5%, then that would be a kind of stagflation, though nothing like the degree experienced in the ‘70s. In the near term, we expect the labor market will more likely just cool, resulting in fewer vacancies rather than unemployment. It is likely that we will enter a recession this year and/or in 2023 but hopefully not stagflation. Much depends on how the economy and businesses react to Fed rate hikes.

Before focusing on the unknown future, we should remind ourselves that in the last 20 years, we’ve seen declining interest rates and low inflation, which in turn caused a seemingly never-ending increase in housing prices. This put extra money into our pockets and drove prices of all assets up, which in turn boosted consumer confidence, as people felt wealthier and were encouraged to spend. In addition, during the last 20-plus years every time the economy stumbled, the Fed worked to bail it out – by lowering interest rates, injecting the market with liquidity. This caused the economy and equity market to recover quickly and without much pain. The pain we were spared was stored, metaphorically speaking, in a pain jar (represented in part as increased debt, income discrepancies) awaiting the next crisis. Today, to prevent inflation turning into hyperinflation, the Fed has no choice but to raise interest rates. We expect that this process will take time and likely be cyclical since the Fed only controls a couple of components. Consumers, by their purchases, will play a role in which companies survive this market cycle. The larger goal is for the business cycle to trim inefficient businesses while avoiding hyperinflation, stagflation, and deflation.

Though price drops are considered a good thing—at least when it comes to your favorite shopping destinations – price drops across the entire economy, however, is called deflation, and that’s a whole other ballgame. Large scale deflation can be really bad news.

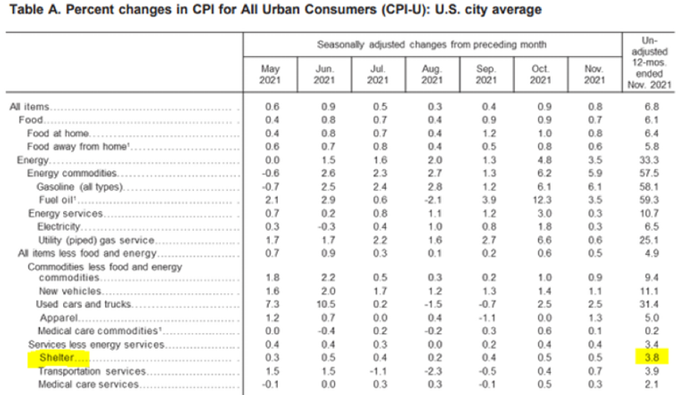

While inflation means your dollar doesn’t stretch as far, it also reduces the value of debt, so borrowers keep borrowing and debtors keep paying their bills and the economy continues to grow. Modest inflation is a normal part of the economic cycle—the economy typically experiences inflation of 1% to 3% per year—and a small amount is generally viewed as a sign of healthy economic growth. You might have heard that 2% is the Fed’s target inflation rate.

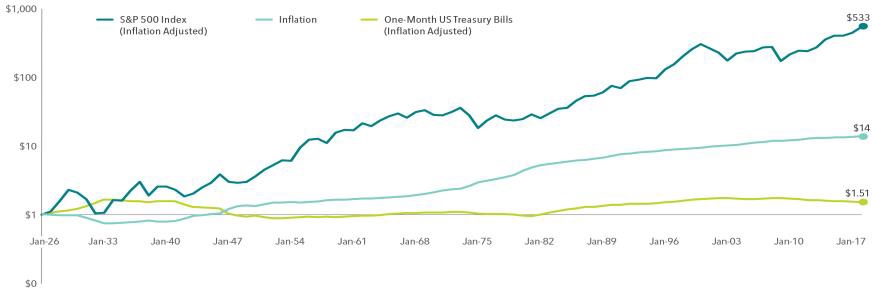

Inflation is also something consumers with assets/resources can protect themselves against, to some extent. Investing in equity markets, for instance, grows your earnings faster than inflation, helping you retain and grow your purchasing power. Protecting yourself against deflation is trickier because debt becomes more expensive, leading people and businesses to avoid new debt. They instead payoff increasingly pricey variable rate debts from prior purchases and avoid new purchases, decreasing growth.

During periods of deflation, the best place for people to hold money is generally in cash investments, which don’t earn much. Other types of investments, like stocks, corporate bonds, and real estate investments, become riskier when there’s deflation because businesses (even businesses with good market performance but with high debt) can face very difficult times or fail entirely.

Overall, in the USA we’ve primarily experienced inflation, not deflation.

As consumers and investors, we don’t control these market components, so what might we do? We focus on what we can control and work to feed the economy while trimming our excess spending.

This is actually a really good time to revisit your financial fundamentals. Do you still have a reasonable emergency fund? Are you spending consciously and aligned with your values and budget? This is certainly a time to re-examine any adjustable-rate debt and determine how to best lock them in. It is also a great time to examine your career and ensure you are professionally valued and not likely in any potential layoff pool. Most importantly, this is a time to get comfortable with what you value and control.

Do not let fear derail what you do. Instead prepare your finances to take advantage of whatever situation presents itself.

Edi Alvarez, CFP®

BS, BEd, MS

www.aikapa.com