An inherited IRA from a loved one used to be a gift to beneficiaries that was easy to implement with little tax impact and a lifetime of reward. In the last four years, the rules have changed dramatically and now inheriting an IRA can result in a surprisingly large tax liability. It now requires detailed understanding of the rules to ensure the correct ones are applied without additional tax liability.

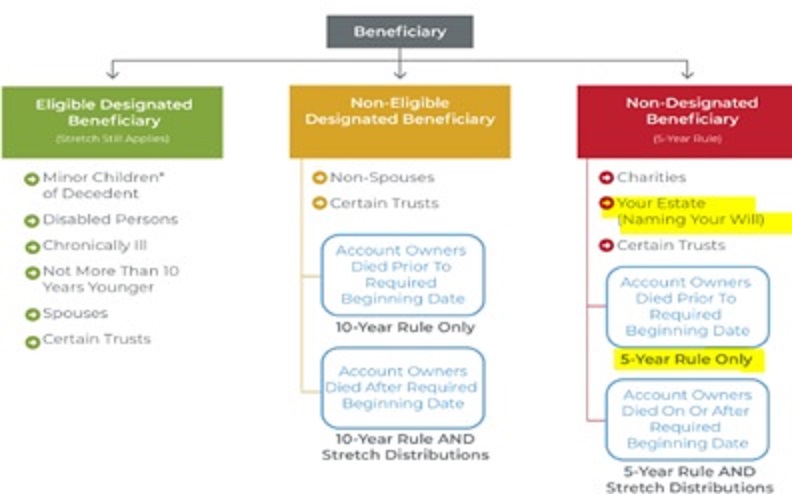

Below are the rules and the process that we follow with inherited IRAs. We first separate beneficiaries into three large categories: (1) eligible designated beneficiary, or (2) a non-eligible designated beneficiary or (3) a non-designated beneficiary.

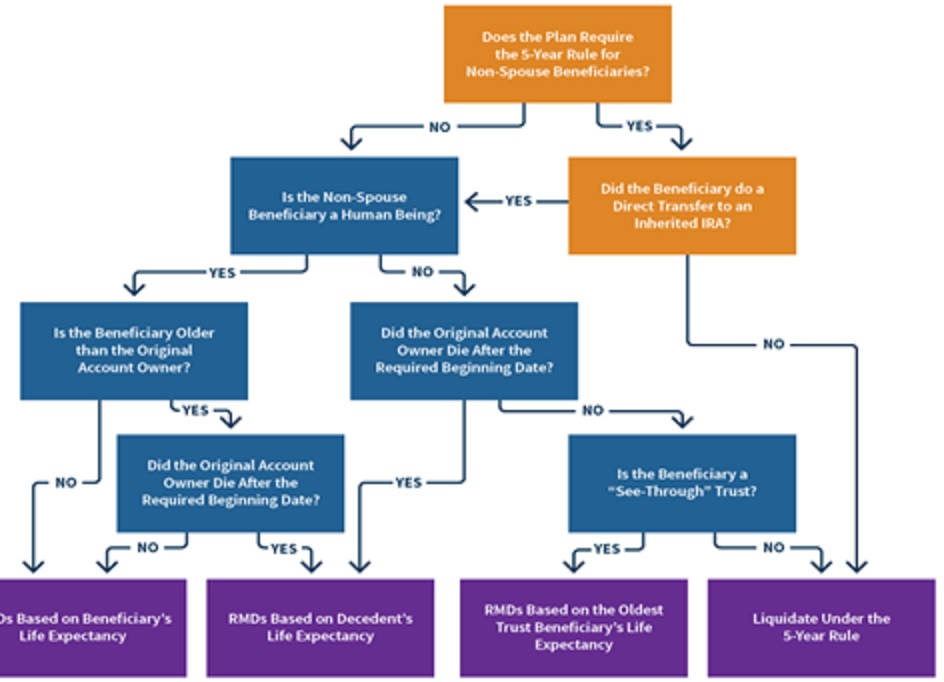

Once we know the type of beneficiary we can drill down and verify by using decedent details (below is a chart for non-spousal beneficiaries).

Why is this important? Because the amount of tax liability is at much higher rates if the withdrawals are forced in 5 rather than in 10 years or over your lifetime. In addition, the custodian needs to be encouraged and educated on the nuances of the applicable rules to your situation so that they don’t choose to use the default 5-year worst case scenario. Sometimes we’ve needed to use legal advice to ensure that the correct beneficiary distribution is implemented by the custodian particularly when the beneficiary is a trust.

The take home message is to make sure beneficiaries are clearly delineated in the IRA account form and that inherited IRA transfers follow the correct inherited IRA beneficiary rules.

Edi Alvarez, CFP®

BS, BEd, MS