Tax planning consists of ensuring that tax liability is appropriate (given the tax code, family finances, and family goals) and that required actions are completed by the deadlines. At year-end, we identify relevant actions and relevant timeline.

Current Year actions …

- Estimate total earnings and total tax withholdings along with any tax-deferral that has or will be made for the current year. Use these and your deductions to estimate Federal and State tax liability.

- Ensure that expected tax liability has been paid either through payroll or through estimated tax payments. It is always best to pay taxes through payroll.

- For the self-employed, estimating taxes and ensuring that enough but not too much tax is paid throughout the year is part of tax planning. This is particularly important for businesses that have no payroll and pay their income tax and self-employment tax (i.e. Medicare and Social Security) simultaneously. Without tax planning, it is common for these businesses to underpay their Federal tax liability.

- Again, estimating profit from business entities (S Corp, C Corp, LLC, or sole proprietorship) allows business owners to adjust cash flow and meet tax deadlines. Business owners often create or contribute to various tax-deferral plans. The largest pre-tax contributions are for plans that have to be created prior to year-end.

- Any deductible contributions to H.S.A., Traditional IRAs or other accounts need to be made by their specific deadlines. These contributions might lower taxable income today (Traditional IRA, pension and 401K) or be tax free in the future (Roth) or both tax free now and in the future (H.S.A.).

- Year-end provides an opportunity to harvest investment accounts and therefore reduce or increase capital gain. Capital gain can be countered against capital losses to provide a net gain or loss which will either increase or decrease tax liability for any given year. We can reduce tax liability by adjusting what we buy/sell (i.e. the lot) at year-end depending on the overall tax burden. Keep in mind that tax rates differ based on taxable income. The federal tax rate for gain can be from zero to 23.8%.

- Estimating overall tax liability prior to year-end allows families to adjust deductions and employers to make needed capital purchases before year-end.

Actions based on next year’s rules …

Since we don’t yet know the tax rules that will apply in 2018, it will be especially difficult to fulfill the second part the year-end tax planning (where we either act or defer actions this year based on comparing the tax code in both the current and coming years).

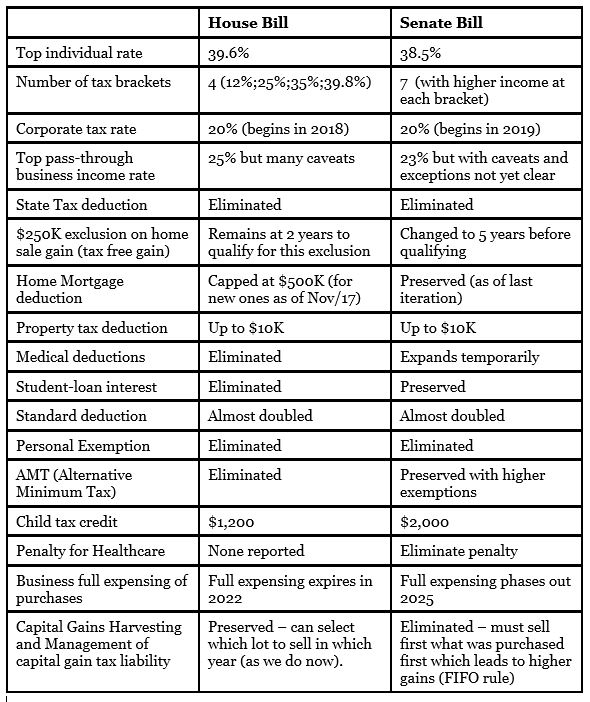

Based on the two tax proposals (House and Senate versions) we consider acting prior to year-end if there is a high probability that a tax advantage will be lost in the new year and it plays a significant role in the person’s finances.

Though neither proposal appears to “simplify” taxes, both bills make significant changes to current tax rules and may, in fact, make it ideal to take some actions before the end of 2017 (taking advantage of current rules), while delaying those that benefit from the rules in the new year.

It will now be the job of the legislative committee to reconcile the differences without inserting any new provisions which will then need to go to the House and Senate for final approval. It is still too early to take action according to one or the other proposal but exploring the impact in light of individual tax circumstances makes sense.

- It may be worth considering accelerating itemized deductions into 2017 that are targeted for elimination. For example State income tax is scheduled to disappear in both proposals. Nevertheless, consideration must be given to unique situations, particularly regarding AMT (Alternative Minimum Tax).

- Consider recognizing tax losses prior to year-end (which is a normal annual year-end tax action) but the ability to select tax lots may disappear in 2018. The new rules may require that sales “first-in-first-out” (FIFO) which results in higher tax liability as it recognize higher gains on the sale of a security. We are hoping FIFO will not survive the reconciliation process but if it does we’ll have to act quickly before Dec 31.

- If you are planning to transfer very large assets between family members you would be well advised to wait until 2018 when there is an increased tax exemption. This doesn’t change the annual gifting which is currently at $14K in 2017 (and will be $15K in 2018).

Though we all want to contribute our share of taxes to sustain our communities and our way of life, it is always prudent to annually evaluate and implement the best way to handle tax liability considering current and future implications.

Edi Alvarez, CFP®

BS, BEd, MS