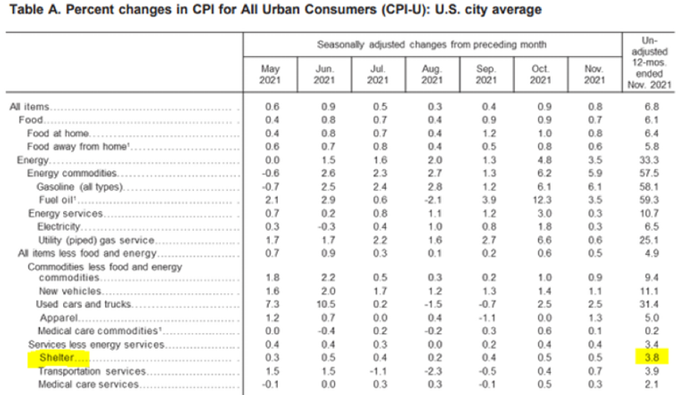

On Tuesday, January 11, 2022, Federal Reserve Chairman Jerome Powell called high inflation a “severe threat” to a full economic recovery and that the central bank was preparing to raise interest rates because the economy no longer needed emergency support. Powell further stated that he was optimistic that supply-chain bottlenecks would ease this year and help bring down inflation while the central bank begins removing the emergency support we’ve depended on for years. The January inflation rate (CPI) is reported at 6.1%. With U.S. debt approaching $30 trillion and growing at $2 trillion per year The Fed is in a tough spot, they must find ways to fight off inflation. Debt is often a drag on future growth unless the debt is used to increase GDP and stimulate the economy. With higher interest rates and without additional economic growth (GDP), the U.S. government will struggle to cover interest payments given that tax revenues are at about $1 trillion per year. So, I expect aggressive measures will be taken to check inflation.To be honest, there is little agreement on the likelihood that 2022 inflation will be permanent. Some believe that the current wave of inflation will prove to be transitory and expect, at worse, a slowing of the global economy in the first half of 2022. Others argue inflation is not temporary and will be devastating through 2023 (they usually use the 1970’s period as a painful reminder of extreme inflation). I am cautiously optimistic and believe that in the long-term what matters is our ability to increase economic growth. I also believe that consumers have a lot more influence over inflation than they realize – inflation is not magical or something to be afraid of but rather a reaction to something we consumers encourage or discourage with our behavior. Every time we purchase something despite its excessive price, or we raise the price despite the actual cost, we contribute to inflation. Consumers can practice restraint over consumer discretionary purchases, but it becomes much more challenging when inflation impacts the essentials or basic spending. For example, if your rent increases at 4% (see the chart below), this is not optional so something else needs to be reduced or your income must increase thus fueling inflation.  In your portfolio we are continually monitoring and adjusting for expected inflationary pressures, volatility, and increased interest rates. Our belief is that with infrastructure funding we’ll reach a high GDP by year-end and a good portfolio outcome. Without economic stimulus we are likely to have a more volatile and less predictable performance this year. You may notice that we added tilts to the portfolio that increased commodities (primarily cereals, materials, energy) and digital/tech assets (like digital supply chain, traditional finance, and fin tech companies) which we expect to do better during inflationary periods. Fixed income is tilted to the short-term and should provide stability if the expected volatility in equity markets materializes. Edi Alvarez, CFP® |

Aikapa Financial Bites

A forum for financial planning and wealth management