Market volatility is part of the deal when investing for the long-term. Currently, some of the volatility is due to inflation and the invasion of Ukraine but most of the volatility is from fear of the unknown (by market participants). We’ve had many periods that generated panic and each time an emotional reaction or seeking ‘safety’ had a price.

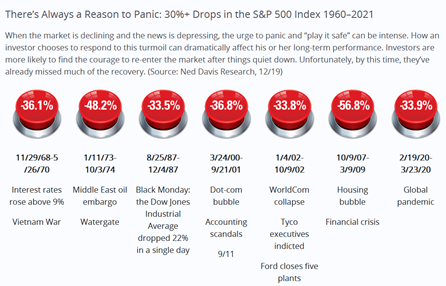

Since 1960, the markets have dropped more than 30% during seven crises.

Instead of seeking ‘safety’ during a crisis, we encourage you to let us do what we do best and make the most of these crises and instead focus on things that you directly control. The best way to handle market volatility is to have a plan in place and let it be executed without ‘fear’.

So, what should you do during periods of volatility?

- Take care of your health by not over focusing on media hype – crises are a bonanza for media outlets. For example, CNN searches were up from 89% to 193% during March of 2020. ‘Googling’ trending topics only makes us more anxious. Online searches will not guide you to how your portfolio and your finances should be managed to get you to your goals.

- Do not check your portfolio every day but do evaluate your anxiety level – if you find that you are overly anxious then we need to re-examine your asset allocation once the market recovers. Keep in mind that unless you depend on the portfolio for cash support, what happens in the market today is not relevant.

- Monitor your cash flow – ensure that you have the cash flow you need and that you have the necessary emergency fund.

- If you have a long-term horizon (meaning that you are not planning to draw from your portfolio over the next 3 years) then view the volatility as dips that we will use to reallocate your portfolio.

- If you depend on the portfolio for ongoing cash flow and we developed a distribution plan for you then you have a withdrawal plan for the next 3-5 years regardless of the market dip. Stay within planned spending.

I don’t deny that there is good reason to be anxious about the war in Ukraine and the impact it will have on our lives and the economy. Even so, this is not the time to decide that you want to make your portfolio ‘safer’. ‘Safer’ often means going to cash or bonds but the time to move to cash is when markets are doing well not during a crisis. During a crisis the ideal action is to use cash to buy positions that will benefit your portfolio in the long-term even if they underperform in the short-term.

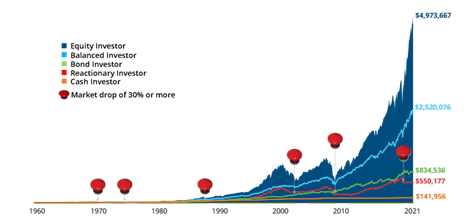

The graph below illustrates how a hypothetical “fearful” investor, who chose safety during market downturns of 30%, missed gains time and time again during market recoveries. This investor traded long-term results for short-term comfort likely because the constant drumbeat of negative news made it difficult to stay true to the investment plan.

But how about market timing? Research shows that market timing strategies do not work well for individual investors. Dalbar’s Quantitative Analysis of Investor Behavior measured the effects of individual investors moving into and out of mutual funds. They found that the average individual investor returns are less—in many cases, much less—than market indices return held through the crisis.

But how about, “it is different this time”? Of course, each crisis is different BUT the US has experienced 26 bear markets since 1929 and the markets recovered all 26 times though some took a long period of time to recover. The key to market recovery is that businesses must continue to make profits.

If you find that you are overly anxious about your portfolio, then record this in your Aikapa folder and let us seriously address your portfolio allocation and the tradeoff to your long-term goals once the market has recovered.

If you find you have unexpected/unplanned cash flow needs from your portfolio, then let’s talk about it and find ways to provide what you need today minimizing damage to your long-term plans.

Edi Alvarez, CFP®

BS, BEd, MS